May 23, 2009

Offline

OfflineSince its missing the 3-Line address it was likely made sometime from November 1882 to Mid-1883. Yes it is a Winchester Reloading Tool.

As far as value goes, I’ve seen them go any where from $40-100. If you bought it on Ebay, look at Ebay’s recent completed auctions listing and that will give you a go idea for what it’ll sell for on Ebay. Bear in mind that Ebay listings will include shipping and their 15% seller’s fee. So prices on Ebay are higher than what you’d get in person at a gunshow. Your tool doesn’t have much bluing left on it, so more towards the lower end of the spectrum in my opinion.

One problem with Ebay is that you often never know if the die cavity is in good condition or not.

Sincerely,

Maverick

![]()

WACA #8783 - Checkout my Reloading Tool Survey!

https://winchestercollector.org/forum/winchester-research-surveys/winchester-reloading-tool-survey/

January 8, 2025

Offline

OfflineMaverick said

Since its missing the 3-Line address it was likely made sometime from November 1882 to Mid-1883. Yes it is a Winchester Reloading Tool.As far as value goes, I’ve seen them go any where from $40-100. If you bought it on Ebay, look at Ebay’s recent completed auctions listing and that will give you a go idea for what it’ll sell for on Ebay. Bear in mind that Ebay listings will include shipping and their 15% seller’s fee. So prices on Ebay are higher than what you’d get in person at a gunshow. Your tool doesn’t have much bluing left on it, so more towards the lower end of the spectrum in my opinion.

One problem with Ebay is that you often never know if the die cavity is in good condition or not.

Sincerely,

Maverick

I gave $65 so not too far off from what you said. Now I just need to get something chambered in 38wcf

thanks again for all the info.

September 22, 2011

Offline

OfflineMaverick said

Since its missing the 3-Line address it was likely made sometime from November 1882 to Mid-1883. Yes it is a Winchester Reloading Tool.As far as value goes, I’ve seen them go any where from $40-100. If you bought it on Ebay, look at Ebay’s recent completed auctions listing and that will give you a go idea for what it’ll sell for on Ebay. Bear in mind that Ebay listings will include shipping and their 15% seller’s fee. So prices on Ebay are higher than what you’d get in person at a gunshow. Your tool doesn’t have much bluing left on it, so more towards the lower end of the spectrum in my opinion.

One problem with Ebay is that you often never know if the die cavity is in good condition or not.

Sincerely,

Maverick

Another problem with eBay is they charge sales tax.

May 23, 2009

Offline

Offlinemrcvs said

Another problem with eBay is they charge sales tax.

You can thank the Supreme Court for that! Before 2018 they didn’t collect sales tax. All online vendors are required to collect sales tax now. Ebay actually fought this decision but had to roll over when Uncle Sam came to collect.

The term “Wayfair” in the context of US law refers to the landmark Supreme Court case South Dakota v. Wayfair, Inc. (2018).

Impact of Wayfair:

- Overturned Physical Presence Rule: The Wayfair decision overturned the long-standing “physical presence” rule established in Quill Corp. v. North Dakota (1992). This rule previously dictated that states could only require businesses to collect sales tax if they had a physical presence within the state (e.g., a store, office, or warehouse).

- Established Economic Nexus: Wayfair introduced the concept of “economic nexus,” which allows states to require businesses to collect sales tax even if they lack a physical presence, as long as they have a significant economic presence (e.g., a certain volume of sales or number of transactions) within the state.

- Impact on Online Retailers: This decision significantly impacted online retailers, as they are now potentially subject to sales tax collection obligations in a larger number of states, based on their economic activity, rather than just their physical presence.

- Increased State Revenue: The Wayfair decision allows states to collect sales tax from out-of-state sellers, potentially generating substantial new revenue.

Key Takeaway:

The Wayfair decision significantly changed the landscape of sales tax collection in the US, particularly for online businesses. It shifted the focus from physical presence to economic activity when determining sales tax obligations, giving states broader authority to require remote sellers to collect and remit sales tax.

![]()

WACA #8783 - Checkout my Reloading Tool Survey!

https://winchestercollector.org/forum/winchester-research-surveys/winchester-reloading-tool-survey/

September 22, 2011

Offline

OfflineMaverick said

mrcvs said

Another problem with eBay is they charge sales tax.

You can thank the Supreme Court for that! Before 2018 they didn’t collect sales tax. All online vendors are required to collect sales tax now. Ebay actually fought this decision but had to roll over when Uncle Sam came to collect.

The term “Wayfair” in the context of US law refers to the landmark Supreme Court case South Dakota v. Wayfair, Inc. (2018).Impact of Wayfair:

- Overturned Physical Presence Rule: The Wayfair decision overturned the long-standing “physical presence” rule established in Quill Corp. v. North Dakota (1992). This rule previously dictated that states could only require businesses to collect sales tax if they had a physical presence within the state (e.g., a store, office, or warehouse).

- Established Economic Nexus: Wayfair introduced the concept of “economic nexus,” which allows states to require businesses to collect sales tax even if they lack a physical presence, as long as they have a significant economic presence (e.g., a certain volume of sales or number of transactions) within the state.

- Impact on Online Retailers: This decision significantly impacted online retailers, as they are now potentially subject to sales tax collection obligations in a larger number of states, based on their economic activity, rather than just their physical presence.

- Increased State Revenue: The Wayfair decision allows states to collect sales tax from out-of-state sellers, potentially generating substantial new revenue.

Key Takeaway:The Wayfair decision significantly changed the landscape of sales tax collection in the US, particularly for online businesses. It shifted the focus from physical presence to economic activity when determining sales tax obligations, giving states broader authority to require remote sellers to collect and remit sales tax.

That decision was wrong. There’s enough other taxes in this country already.

Ivalso think used items should be exempt from sales taxes as, theoretically, a tax was paid on them originally.

May 23, 2009

Offline

OfflineWell I guess throw your tea in the harbor and write your congressman and see how far that gets you. I know if you don’t pay it, they’re quick to throw you in jail, or at the very least suspend your driving status. You know its a scam when you find out that you can pay owed taxes with a credit card.

![]()

WACA #8783 - Checkout my Reloading Tool Survey!

https://winchestercollector.org/forum/winchester-research-surveys/winchester-reloading-tool-survey/

January 8, 2025

Offline

OfflineUpon further investigation tonight. I did miss the 3 letter address on the obverse due to pitting. Armed with the information now, I know what a deal is. Not unhappy with my purchase. Thanks

Also, the box of green tea in the cupboard is going to nearest municipal body of water tomorrow morning.

Thanks,

Adam

April 3, 2018

Offline

OfflineNew addition:

Winchester 3-line Manuf address-reloading tool, stamped 45-60 WCF -Pat date Sept 14, 1880 stamped

Winchester 45-60 bullet mold, stamped 45-60 (Appears to be casting 300 gr FP bullets). Three-line WRA address also on 45-60 bullet mold

{This set accompanying /used for: An 1885 Winchester HW SS; 45-60 WCF-30 in full oct-Shipped in 1886.}Mid-range Winchester Vernier sight.

Note-the 45-60 WCF was also a chambering in the 1876 Model.

Bert has this 1885 SN in his 1885 SS survey, as the 45-60 WCF was a relatively rarer chambering in this SS Model.

May 23, 2009

Offline

OfflineI take it that on the 1880 Tool the 3-Line address is on the back side of the tool, Or not on the same side as the patent date/caliber stamp?

Does the bullet mold have wood handles?

![]()

WACA #8783 - Checkout my Reloading Tool Survey!

https://winchestercollector.org/forum/winchester-research-surveys/winchester-reloading-tool-survey/

October 19, 2008

Offline

OfflineThis might be of interest:

http://library.centerofthewest.org/digital/collection/WRAC/id/10152/rec/1

Jim

May 23, 2009

Offline

OfflineJim,

Thanks. I look through Cody’s files pretty regularly and have known about this list for years. Dan Shuey and I discussed it thoroughly over the years.

I just wish it had the corresponding drawings that are noted on the list. Another great example of a piece of the puzzle. It also shows you the extent that Winchester was willing to go to meet their customer’s needs. 182 different calibers produced in their bullet molds is no small order.

Sincerely,

Maverick

![]()

WACA #8783 - Checkout my Reloading Tool Survey!

https://winchestercollector.org/forum/winchester-research-surveys/winchester-reloading-tool-survey/

April 3, 2018

Offline

OfflineMaverick:

Late answer to # 69 above: the 45-60 stamping is directly above the 1880 patent date, while the 3-line address IS on the back side of the tool. The 300 gr FP bullet mold has wooden handles.

NOTE: The 1885 HW Single Shot rifle in 45-60 WCF (SN 6651) to which these tools are paired was made in 1886 as noted earlier. The bore is still in excellent condition, and it will still utilize 300 or 400 gr FP bullets, not paper patched. Accurate enough to have recently dispatched a roaming coyote at 70 yards. “Still shooting after all these years.” Both Oliver Winchester and John Browning would appreciate that.

Ridge Marriott

Lt Col-USA-Ret

May 23, 2009

Offline

OfflineDon,

I sent you a PM.

Thanks.

Maverick

![]()

WACA #8783 - Checkout my Reloading Tool Survey!

https://winchestercollector.org/forum/winchester-research-surveys/winchester-reloading-tool-survey/

October 19, 2008

Offline

OfflineA couple of “new to me” tools:

1) Model 1894 with die marked 30 GOV. with decapping pin marked 30 CAL.

2) Model 1894 with die marked 30 GOV. S.R.

3) Bullet mould marked 30 GOV. S.R. with wood handles

4) Model 1882 marked 22 W.C.F. with decapping pin marked 22 WCF

5) Bullet mould handles marked 22 W.C.F. with wood handles

As would be expected, all above (except, of course, the decapping pins) carry the standard MANUFACTURED BY THE WINCHESTER REPEATING ARMS CO. etc. markings. Let me know if there’s any other info you need.

Jim

May 23, 2009

Offline

Offline30Gov03 and win4575

I very much appreciate the information as it is most helpful for me to get estimates on surviving quantities. One problem I have with my survey is that unlike the rifles, I don’t have the benefit of cataloging things by a serial number. And I kind of have to keep track via the collector that provided the information to me and also somewhat visually. If you gentlemen additionally can PM or email pictures, they can also be most helpful and I will try to explain and show why.

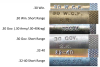

So if you look at this picture. It compares caliber markings for the 1894 Tool Dies of the regular and short range versions. But I’m also looking for specific variations. For example, look at the 30WCF & 30Gov S.R. marks compare to the 32-40 S.R. marks as to their locations. Where the S.R. marking is placed is different.Here is a early DRAFT chapter page for the 1894 Tool regarding Patent Address variations. Thus far I’ve found 5 different types and theorize as to why they vary from one another. I have since learned that the factory also had a “Stamp Book” that may have kept track of such changes in roll die markings. No different that what can be found on Barrel Address markings and Upper Tang markings. So they are not all the same throughout production. Just like with the rifles! Here is a another early DRAFT chapter page for the 1882 Tool regarding Patent Address variations. Not only did the markings change, but where they were placed / located also changed. There are also variations in the types and sizes and shapes of the fonts used. Just like with the barrel markings and upper tang markings on the rifles. Here is an example of the 1880 Tool and how the Winchester Express marking have variations and even errors. Here is examples of variations for the 50-100-450 caliber markings on the 1894 Tool Die.

I hope this helps to show why pictures can be most helpful in regards to my specific research into Reloading Tools, etc. and the more information the better. Thanks in advance.

Sincerely,

Maverick

P.S. May God Bless you and yours.

![]()

WACA #8783 - Checkout my Reloading Tool Survey!

https://winchestercollector.org/forum/winchester-research-surveys/winchester-reloading-tool-survey/

October 19, 2008

Offline

OfflineMaverick,

Well, apparently, I need to pull out all my Winchester tools and get photos of them to you. I’ll get to work on that.

Meanwhile, I can tell you that my Model 1894 tool’s 30 GOV. S.R. die is stamped all on one line, like the 32-40 S.R. example in the photo in your post No.77.

Jim

1 Guest(s)

Log In

Log In